Posts by tag

long-term care

Medicare Heads Up: January 24, 2020

January 24, 2020 – Headlines in this week's edition: Some Medicare Part D enrollees find themselves without coverage; Medicare beneficiaries not using covered… Read more

Disability and long-term care: What’s next?

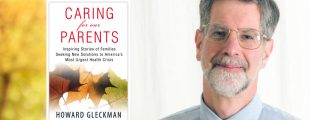

January 7, 2013 – Howard Gleckman, one of the nation’s leading experts on family caregiving and long-term care and author of Caring for our Parents, talks… Read more

ACA’s CLASS Act pushed over the fiscal cliff

January 2, 2013 – CLASS was designed to complement private long-term care insurance, Medicare, Medicaid, and public disability programs. For Medicare… Read more