You're on your way!

You're being directed to a third-party site to get a quote.

Since 2011, we've helped more than 5 million visitors understand Medicare coverage.

By shopping with third-party insurance agencies, you may be contacted by a licensed insurance agent from an independent agency that is not connected with or endorsed by the federal Medicare program.

These agents/agencies may not offer every plan available in your area. Please contact Medicare.gov or 1-800-Medicare to get information on all options available.

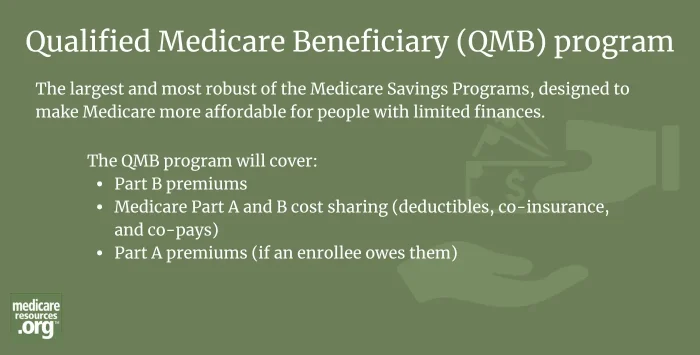

Some Medicare beneficiaries struggle to pay for Medicare premiums and cost sharing even though their incomes are too high to qualify for full Medicaid benefits. A group of Medicaid-administered programs – Medicare Savings Programs (MSPs) – can help to pay Medicare premiums and out-of-pocket costs for eligible enrollees.

There are four types of MSPs, but the Qualified Medicare Beneficiary (QMB) program is the largest, and covers the majority of the people with MSPs.1

The QMB program goes further than the other MSPs in terms of what it covers. In addition to Part B premiums, QMB will also pay an enrollee’s Medicare Part A and B cost sharing (deductibles, co-insurance, and co-pays) and Part A premiums (if an enrollee owes them).2 And all MSP enrollees, including QMB enrollees, receive Extra Help – a federal program that lowers their Medicare Part D drug costs.3

All MSPs, including the QMB program, are administered by each state’s Medicaid program. So you’ll need to contact your state’s Medicaid office to see whether you’re eligible and to submit an application.

Footnotes