What is the Specified Low-Income Medicare Beneficiary (SLMB) program?

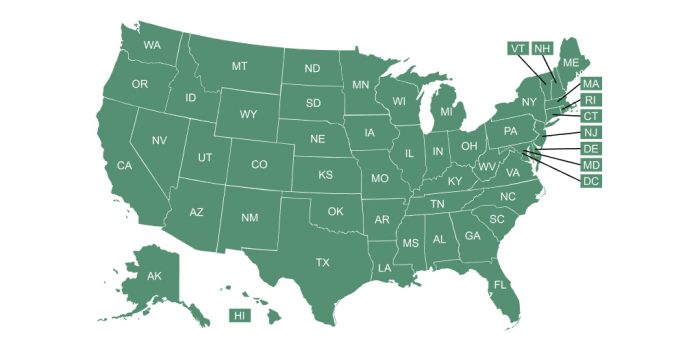

The Specified Low-Income Medicare Beneficiary (SLMB) program is a Medicare Savings Program (MSP) that pays for an enrollee’s Medicare Part B premiums. MSPs are federal programs that are administered by Medicaid in each state.

Who is eligible for the Specified Low-Income Medicare Beneficiary (SLMB) program?

The SLMB program is available to Medicare beneficiaries with low incomes and low asset/resource levels. The specific details are adjusted annually.

In 2025, the SLMB program is available to a single Medicare beneficiary with an income up to $1,585 and to a married couple with an income up to $2,135 (higher in Alaska and Hawaii, and higher in some other states).

In addition, a single individual’s assets/resource total in most states must not exceed $9,660 in 2025, and the asset/resource limit for a married couple is $14,470.

Unlike the Qualified Individual (QI) program, which is another MSP that has higher income limits (but the same asset limits) and that also pays Part B premiums, people enrolled in SLMB do not have to reapply each year.

How much benefit does the Specified Low-Income Medicare Beneficiary (SLMB) program provide?

As of 2025, the Medicare Part B premium for most enrollees is $185/month. SLMB enrollees no longer have this amount deducted from their Social Security benefit, which boosts their Social Security checks by a total of $2,220 in 2025.

Individuals who are approved for SLMB can receive three months of retroactive benefits.

It can take two to three months between being approved for MSP benefits and the time Part B premiums are no longer deducted from Social Security income. Applicants should receive a one-time deposit for premiums that were withheld after they were enrolled in the program, and a payment for their retroactive benefits.

Does the Specified Low-Income Medicare Beneficiary (SLMB) program provide any benefits other than the Part B premium payment?

Unlike the Qualified Medicare Beneficiary (QMB) program, SLMB does not pay for Parts A and B cost sharing (e.g. deductibles, co-pays and coinsurance) or for Part A premiums (if an enrollee owes them).

But SLMB enrollees automatically receive Extra Help – a federal program that lowers premiums and out-of-pocket costs for Medicare Part D prescription drug coverage.

Footnotes

Tags: Medicare Savings Programs