In the past, we’ve asked our readers how often they reviewed their Medicare Part D options. Interestingly, 60% did not check their plans annually to see if another one better suited their needs.

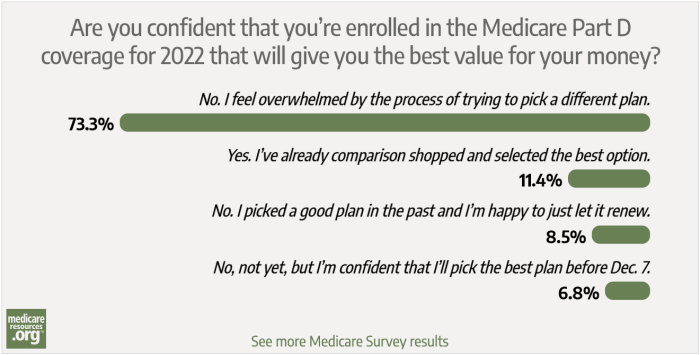

In our most recent survey, we took it a step further. We asked how confident our readers were with comparison shopping for a Medicare Part D plan during the 2022 Medicare Annual Enrollment Period. Here’s what we learned from more than 350 survey responses:

- 73.3% said they were overwhelmed by the options.

- 11.4% said they had already comparison shopped and selected the best option.

- 8.5% said they picked a good plan last year and were happy to just renew it.

- 6.8% said they would review their options and choose a plan before December 7.

The responses aligned with a recent survey released by the Kaiser Family Foundation. They found that as many as 7 out of 10 people do not comparison shop for Part D plans during Medicare open enrollment.

Nearly three-quarters overwhelmed by their Part D options?

Sadly, I was not at all surprised by this result. As a physician, I give several free Medicare talks in my community during Medicare open enrollment, and participants always tell me they’re overwhelmed by Part D – whether it’s about how much they could pay for their medications or concern about whether they will hit the coverage gap.

Unless someone knows the lingo and has experience navigating the Medicare system, it is a lot to take in. Even as a physician helping friends and family, as someone who does know the lingo, I find the process overwhelming at times too. And unfortunately, with so many options out there, consumers sometimes suffer from decision paralysis. It’s easier to take the path of least resistance and stick with what you know.

As a physician, I am concerned because I know that patients are not always getting the care they deserve. They may be wasting dollars that could be better spent on other parts of their healthcare experience, and quite frankly, on life in general. The problem is that not changing plans can literally cost them.

This year I consulted with someone who is on several medications that did not have generic options. He told me he was convinced his current Part D plan was still a good fit. But when we went through it together, we discovered coverage that will save him $800 next year! Those are some hefty financial consequences!

Not changing plans could increase your out-of-pocket costs and could be disruptive to your care, especially if it changes your ability to access medications you need.

Searching for the most affordable Part D plans

With the large majority of our readers not sure how to approach choosing a Part D plan, we wanted to take the opportunity to guide you through the process and make things easier.

When you are new to Medicare or when Medicare open enrollment (also known as the Annual Election Period or AEP) comes around, you will be bombarded with advertisements trying to sell you Medicare coverage. Whether it’s snail mail, e-mail, or radio/television ads, it is no wonder that nearly three-quarters of our readers get flustered. Information comes from every direction and it can be difficult to know where to start.

One reliable first step is to visit the federal Medicare site and simply search for a Part D plan in your zip code. To get the most helpful information, enter your current medications. This will include the dose, the number of pills, and how often you fill each prescription.

You could pay more or less depending on which pharmacy you use. That is why you will then pick the pharmacies you would be most comfortable using, whether they are mail order or local pharmacies. You can pick up to five of them to compare. Because each Part D plan has its own list of preferred pharmacies, this will allow the search engine to give a better cost comparison between plans.

The search engine will do the rest. It will calculate the Yearly Drug and Premium Cost for each plan. This is the total amount you will pay out of pocket for your plan premiums and the cost of all your medications over the course of the year. At a glance, you can see which plans are most affordable.

How to find the best Part D plan for you

Having an affordable plan is important but that does not mean it is necessarily the best plan for your situation. You may need to look a bit closer.

Knowing how much you will pay over the course of the year is helpful, but it does not give the full story. If you are someone who reaches the coverage gap, also known as the donut hole, you may have to pay more at different times of the year. Depending on your source of income, this may not always be feasible. You may need to consider plans that do not exceed a certain dollar amount each month.

Within the Medicare Plan Compare search engine, you can select Plan Details to see whether or not you would be affected by the coverage gap and to see the breakdown of monthly costs for each pharmacy. This may help you make your decision.

You may also want to take a plan’s Star Rating into consideration. Plans that have higher ratings may offer better customer service and a better member experience.

Take time to review your Annual Notice of Change

If you have taken all these steps in the past, sticking with your plan may sound like a good idea. As many as 8.5% of our readers thought so. While it could still be the best plan, it’s in your best interest to make sure.

Every year your Part D plan will send you an Annual Notice of Change. This summary will be mailed to you in late September and will outline any changes in your plan that would start on January 1. This will include updates on costs, formulary changes, and your service area. An Evidence of Coverage form will also be mailed to you at this time. This is a more comprehensive list of your plan’s costs and benefits for the new year.

If you do not get these forms prior Medicare open enrollment, you should reach out to your plan.

When you review these documents, look to see if there will be changes to your Part D plan that will affect your bottom line.

- Are your premiums, deductibles, copays or coinsurance going up?

- Will all of your medications be covered next year?

- Are any of your medications being moved to a different tier (e.g., the higher the tier, the higher the cost)?

- Will any of your medications require a prior authorization?

- Will any of your medications have quantity limits (e.g., you can get no more only get a set number of pills at a time)?

- Is your pharmacy still in the plan’s network and if so, is it a preferred pharmacy?

Even if there are no changes to your plan, it is possible that another Part D plan could still offer you a better deal. Comparison shopping may be worth the effort.

Don’t go it alone

If this level of detail is overwhelming (exactly what we are trying to avoid!), know that you are not alone. There are a number of resources available to you.

As always, you can reach out to Medicare directly. The Medicare hotline is 800-MEDICARE (800-633-4227).

You can also contact your State Health Insurance Assistance Program (SHIP) for free one-on-one Medicare counseling to guide you through the process. Keep in mind that although SHIP counselors can offer advice, they cannot enroll you in a plan.

Working with a licensed insurance agent that specializes in Medicare can be helpful too. Unlike corporate representatives from specific carriers, they are well versed in plans cross a number of insurance companies. It costs nothing to use their services, they can give you unbiased advice about available plans, and they can help you enroll in the plan you choose.

Tanya Feke, M.D. is a licensed, board-certified family physician living in New Hampshire. As a practicing primary care physician in Connecticut and an urgent care physician in New Hampshire, she saw first-hand how Medicare impacted her patients. In recent years, her career path has shifted to consultant work with a focus on utilization management and medical necessity compliance.

Dr. Feke is an expert in the field, having Medicare experience on the frontlines with patients, hospital systems, and insurers. To educate the public about ongoing issues with the program, she authored “Medicare Essentials: A Physician Insider Reveals the Fine Print.” Her analysis of Medicare issues is frequently referenced by the media, and she is a contributor to multiple online publications.