You're on your way!

You're being directed to a third-party site to get a quote.

Since 2011, we've helped more than 5 million visitors understand Medicare coverage.

By shopping with third-party insurance agencies, you may be contacted by a licensed insurance agent from an independent agency that is not connected with or endorsed by the federal Medicare program.

These agents/agencies may not offer every plan available in your area. Please contact Medicare.gov or 1-800-Medicare to get information on all options available.

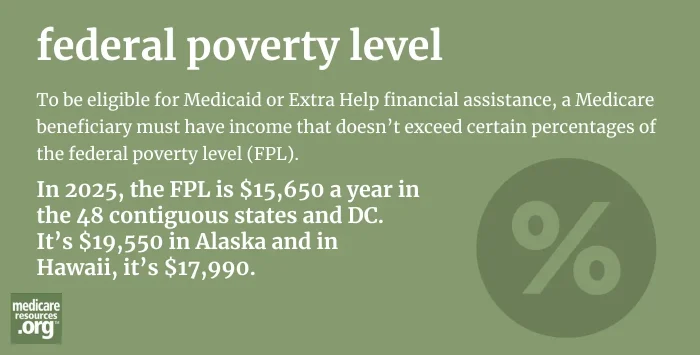

To be eligible for Medicaid (as a full dual-eligible beneficiary, or for partial assistance with things like Medicare premiums and out-of-pocket costs) or Extra Help financial assistance, a Medicare beneficiary must have income that doesn’t exceed certain percentages of the federal poverty level (FPL).1

Eligibility varies depending on the program, with more assistance available to people with lower incomes. Asset tests are also used in most states when the applicant is 65 or older, meaning that the person must have limited assets in addition to a fairly low income in order to qualify for assistance through the Medicaid program.2 (As opposed to Medicaid for children, pregnant women, and adults under age 65, which is based on income alone, as a percentage of the federal poverty level, regardless of assets.)3

The FPL, which changes annually and is published in January each year by HHS, is $15,650 for a single person in 2025. This number is used to calculate eligibility limits for the various Medicaid programs. The specific percentage of FPL that’s used differs from one program to another.

Footnotes