You're on your way!

You're being directed to a third-party site to get a quote.

Since 2011, we've helped more than 5 million visitors understand Medicare coverage.

By shopping with third-party insurance agencies, you may be contacted by a licensed insurance agent from an independent agency that is not connected with or endorsed by the federal Medicare program.

These agents/agencies may not offer every plan available in your area. Please contact Medicare.gov or 1-800-Medicare to get information on all options available.

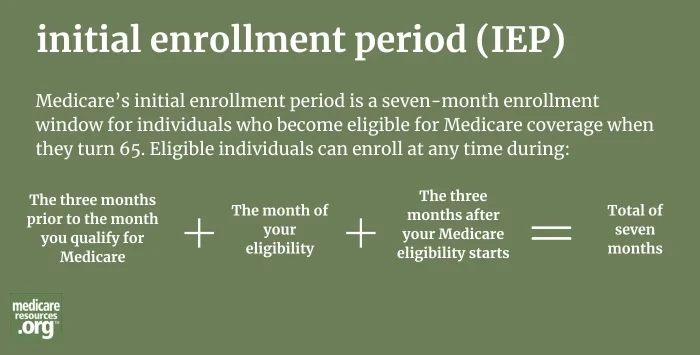

Medicare’s initial enrollment period (IEP) is the enrollment window when Americans become eligible for Medicare. The period includes the three months prior to the month you qualify for Medicare, plus the month of your eligibility, plus the three months after your Medicare eligibility starts – a total of seven months.

For reference, the month of your eligibility will typically be the month you turn 65 (or the month before that, if your birthday is the first of the month), but it can also be your 25th month of receiving Social Security Disability benefits,1 or the month you become eligible for Medicare due to ALS or ESRD.

During the IEP, Americans can enroll in Medicare Part A and Part B (together known as Original Medicare), and Part D prescription drug coverage. If you’re eligible for Original Medicare, you have the option of enrolling in Medicare Advantage (Medicare Part C). Here’s how to enroll in the various Medicare plans.

You’ll have an IEP if you’re newly eligible for Medicare for any reason, and get a second IEP if you qualify for Medicare for a second reason. This can happen, for instance, if you first qualify because of a disability and then re-qualify at age 65, or if you’re age 65 or older and develop End Stage Renal Disease (ESRD). If you owe a Medicare Part B or Part D late-enrollment penalty, this will be erased when you re-qualify for Medicare, assuming you enroll during your new initial enrollment period.2

Footnotes