What is estate recovery?

Long-standing federal rules require states to attempt to recover Medicaid costs for long-term care (provided in a nursing home or via a Home and Community Based Services waiver) from the estates of enrollees who received that care while age 55 or older. States can choose to also recover the costs of all other Medicaid services (not just long-term care) for those enrollees. The process of recovering from an enrollee’s estate is called estate recovery.

States can also pursue estate recovery from Medicaid enrollees below age 55 who resided in an institution permanently. Most of these individuals would have lived in a nursing home or intermediate care facility for individuals with intellectual and developmental disabilities (ICF/DD).

Estate recovery programs have been mandatory for states since they were required by the Omnibus Budget Reconciliation Act of 1993. But states take varying approaches to estate recovery that goes beyond the federal requirements.

When a Medicaid enrollee’s coverage was administered by a Managed Care Organization (i.e., a private insurer with whom the state contracts to administer Medicaid coverage), the state can attempt to recover the fees (capitation payments) that the state paid to the insurer. This means the amount recovered could differ from the cost of services received – and could result in a significant estate recovery from enrollees who didn’t use much care (or, conversely, estate recovery that’s less than the total cost of care if the person received a substantial amount of Medicaid managed care).

Estate recovery only has to apply to the portion of an enrollee’s estate that is subject to their will (known as their “probate estate”). States have the option of also recovering assets that aren’t subject to probate, and many have chosen to do this.

States are not allowed to recover from an enrollee’s estate if they are survived by either a spouse or a child who is under 21 years old, blind or disabled. Estate recovery is allowed to occur once the spouse dies, or the child turns 21 or is no longer considered disabled. But many states don’t pursue estate recovery in those circumstances.

Each state can also establish a process to allow individuals who would inherit from a Medicaid enrollee to request a “hardship exemption” from estate recovery.

Does estate recovery apply to Medicare beneficiaries?

The estate recovery program is part of Medicaid. Medicare does not have an estate recovery program. But a significant number of Medicare beneficiaries who need nursing home care are dually eligible for Medicaid and Medicare. This means Medicare covers their medical costs, while Medicaid covers their long-term care costs and provides secondary coverage for medical costs. For these individuals, the state can use estate recovery to recoup the costs that were paid by Medicaid.

However, some people who are dually eligible for Medicare and Medicaid are not eligible for full Medicaid benefits. Instead, they’re eligible for Medicaid-funded Medicare Savings Programs (MSPs), which help to cover Medicare premiums and out-of-pocket costs. MSPs do not cover long-term care services. And MSP benefits are not subject to estate recovery, even though they’re funded by Medicaid.

How did the ACA affect Medicaid estate recovery?

When the Affordable Care Act (ACA) allowed states to expand Medicaid to enrollees ages 19 – 64 with incomes up to 138% of the federal poverty level, a new group of Medicaid enrollees between ages 55 and 64 began facing potential estate recovery in states that recovered costs that were not long-term care related.

In anticipation of the Medicaid expansion, some states chose to exempt enrollees who did not receive long-term care benefits from estate recovery, and others pared back their existing estate recovery programs so they only recovered costs related to long-term care. But some states that have expanded Medicaid do pursue estate recovery from Medicaid expansion enrollees, for all Medicaid-funded services received after the person is 55 years old.

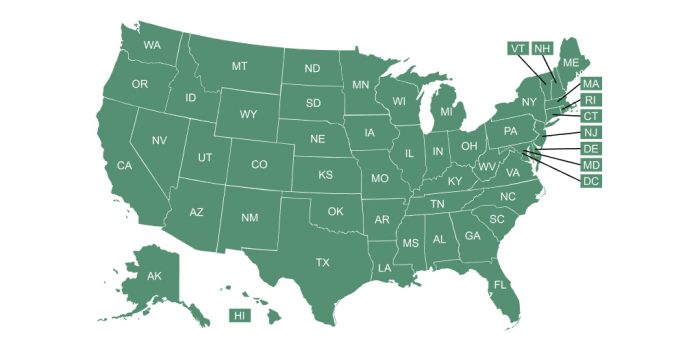

You can click on your state on this map to learn more about how Medicaid estate recovery is handled.

Footnotes