What is a special income limit (SIL)?

Although Medicare does not cover custodial long-term care services, Medicaid does. Medicaid is the primary payer for more than six out of ten nursing home residents in the U.S.

Due to the high cost of long-term care, most states have a “special income limit” for Medicaid long-term care benefits that is higher than the income limit for other Medicaid programs, although they generally use the same low asset/resource limit that applies to other Medicaid enrollees whose eligibility is based on both income and assets.

- Medicaid eligibility is based solely on income for children, pregnant women, and adults under age 65.

- Medicaid has income and asset/resource limits for adults age 65 and older, and for people whose eligibility is based on blindness or disability.

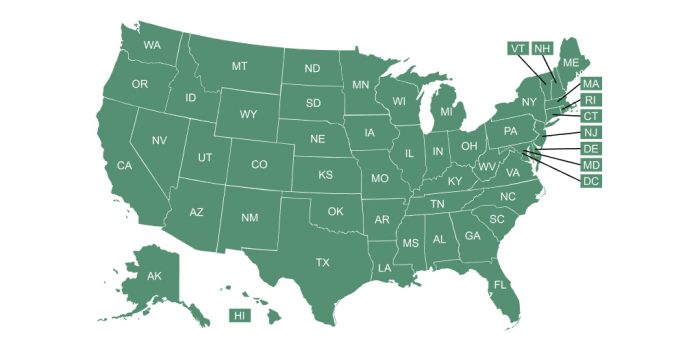

Do all states have special income limits for Medicaid long-term care benefits?

As of 2025, the special income limit is used in 41 states to determine eligibility for Medicaid nursing home benefits and long-term in-home care programs.

How much is the Medicaid special income limit for long-term care benefits?

The special income limit is set at 300% of the Supplemental Security Income (SSI) payment amount. In 2025, that amounts to $2,901 a month.

The SIL that’s used to determine eligibility for Medicaid long-term care benefits is higher than the income limit for other Medicaid benefits for aged and disabled individuals. In most states, the income limit for aged/disabled Medicaid (when long-term care isn’t needed) usually isn’t more than the poverty line, or a monthly income of $1,304 for individuals and $1,762 for a couple.

Using a SIL for Medicaid nursing home benefits does not mean enrollees can keep all of their income below this limit – because most of it must be paid toward their care. But some states allow HCBS recipients to keep all of their income up to the SIL.

Footnotes

Tags: long-term services and supports