You're on your way!

You're being directed to a third-party site to get a quote.

Since 2011, we've helped more than 5 million visitors understand Medicare coverage.

By shopping with third-party insurance agencies, you may be contacted by a licensed insurance agent from an independent agency that is not connected with or endorsed by the federal Medicare program.

These agents/agencies may not offer every plan available in your area. Please contact Medicare.gov or 1-800-Medicare to get information on all options available.

EDITOR’S NOTE: Our Medicare Surveys “take the pulse” of our audience – assessing our readers’ experiences with Medicare and their attitudes toward the program. The questions and the results are not intended to be scientific.

It’s easy to glance at the results of our most recent survey and conclude that Medicare enrollees are having trouble finding better Medicare coverage options during open enrollment. But I think the results are actually encouraging.

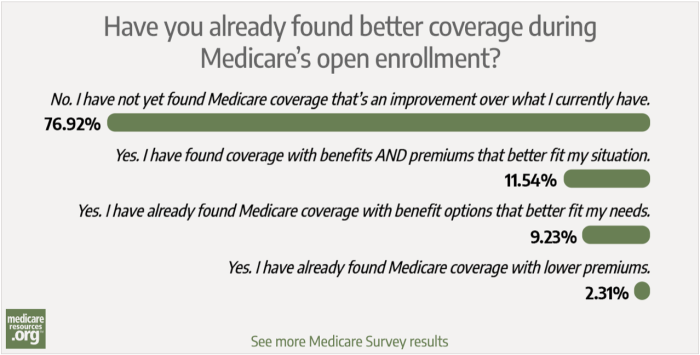

We asked: “Have you already found better coverage during Medicare’s open enrollment?” The responses?

So what’s encouraging about 77% of our readers noting they haven’t yet found better coverage? It’s the other number – the 23.1% who have shopped around and either found coverage with better benefits or lower premiums (or both) for 2021. That percentage (23.1%) is actually high when you consider historical data about the tendency of Medicare enrollees to change plans.

The 2022 Medicare Open Enrollment Guide offers tips for reevaluating your Medicare coverage – and explains how you can make plan changes. Medicare open enrollment runs from November 1 through Dec. 7.

Relatively few Medicare beneficiaries change their Medicare Advantage or Part D plans each year. In fact, 2016 survey of Medicare Advantage enrollees found that only 11 percent of Medicare Advantage Prescription Drug (MAPD) enrollees voluntarily chose to switch to a different plan – and this statistic had remained relatively constant since 2007. Older data have also shown a similarly small number of Original Medicare beneficiaries change their Part D plans each year.

At the same time, other data has shown that Medicare beneficiaries’ likelihood of sticking with Medicare Advantage plans actually increases over the time period they’re enrolled in a given plan. In fact, half of all MA enrollees will remain in the same plan over a five-year period.

It’s worth noting that Medigap plans —which are used as supplemental coverage by millions of Original Medicare beneficiaries — do not have an annual open enrollment window in most states. The October 15 – December 7 open enrollment period only applies to Medicare Advantage plans and Medicare Part D plans. In most of the country and in most circumstances, people who wish to change from one Medigap plan to another must go through medical underwriting, although they can submit an application to do so at any time during the year.

That 76.9% of our readers haven’t yet found better coverage and/or lower premiums this fall is pretty easy to explain. Most beneficiaries are either: (1) satisfied with their current coverage or (2) uncomfortable enough with the idea of switching plans that they’ll continue in their existing plan – even though its benefits and coverage might change significantly next year.

Policy experts call this tendency of Medicare enrollees to stay in their current plan from one year to the next “stickiness.” It means many beneficiaries would prefer to simply keep their current coverage over comparison-shopping for a new plan – which requires analyzing different provider networks, co-pay amounts, premiums, and prescription drug coverage.

I know from my own experience that many enrollees don’t shop during Medicare open enrollment because they’re uncomfortable with considering a new plan – or believe that their access to providers and cost-sharing will be the same next year. Older adults and people with disabilities are often managing medical conditions, which can make it even more difficult to compare plans and contemplate changing coverage.

Unfortunately, these enrollees usually aren’t aware of the degree to which Medicare Advantage plans change yearly – or they’re aware but don’t know what to do about it.

My advice to these beneficiaries is to make yourself a little uncomfortable – and shop around. There is, after all, no harm in shopping for different coverage. You can always remain in your current plan if you don’t like the alternatives.

This advice is especially important when it comes to Part D prescription drug plans. Original Medicare beneficiaries usually have stand-alone Part D coverage – and should always consider swapping that coverage out each year based on next year’s prescription drug plan premiums and formularies.

Unlike switching Medicare Advantage plans – which can be disruptive – there is usually zero downside to changing your stand-alone Part D plan, other than switching to a new pharmacy. (Many Part D insurers – including Medicare Advantage plans with prescription drug benefits – require fills for 90-day supplies of medication to occur through a designated mail-order pharmacy. This means you might have to set up a new mail-order account if you receive maintenance medications through the mail.)

Although those changes might seem like a hassle, having the right Part D plan can save you hundreds – or even thousands – of dollars in premiums and co-pays each year.

If you’re among the nearly 80% or so of readers who haven’t yet found better coverage, the good news is that there are two weeks remaining in Medicare open enrollment – and great options for comparing coverage.

You can compare options using this site’s free quote tool, but if you need to talk with someone, you can find a State Health Insurance Assistance Program (SHIP) counselor in your area, call a 1-800-MEDICARE agent, or reach out to a licensed Medicare agent.

Josh Schultz has a strong background in Medicare and the Affordable Care Act. He coordinated a Medicare assistance contract at the Medicare Rights Center in New York City. Josh also helped implement health insurance exchanges at the technology firm hCentive. He has also held consulting roles, including at Sachs Policy Group, where he worked on Medicare and Medicaid issues.