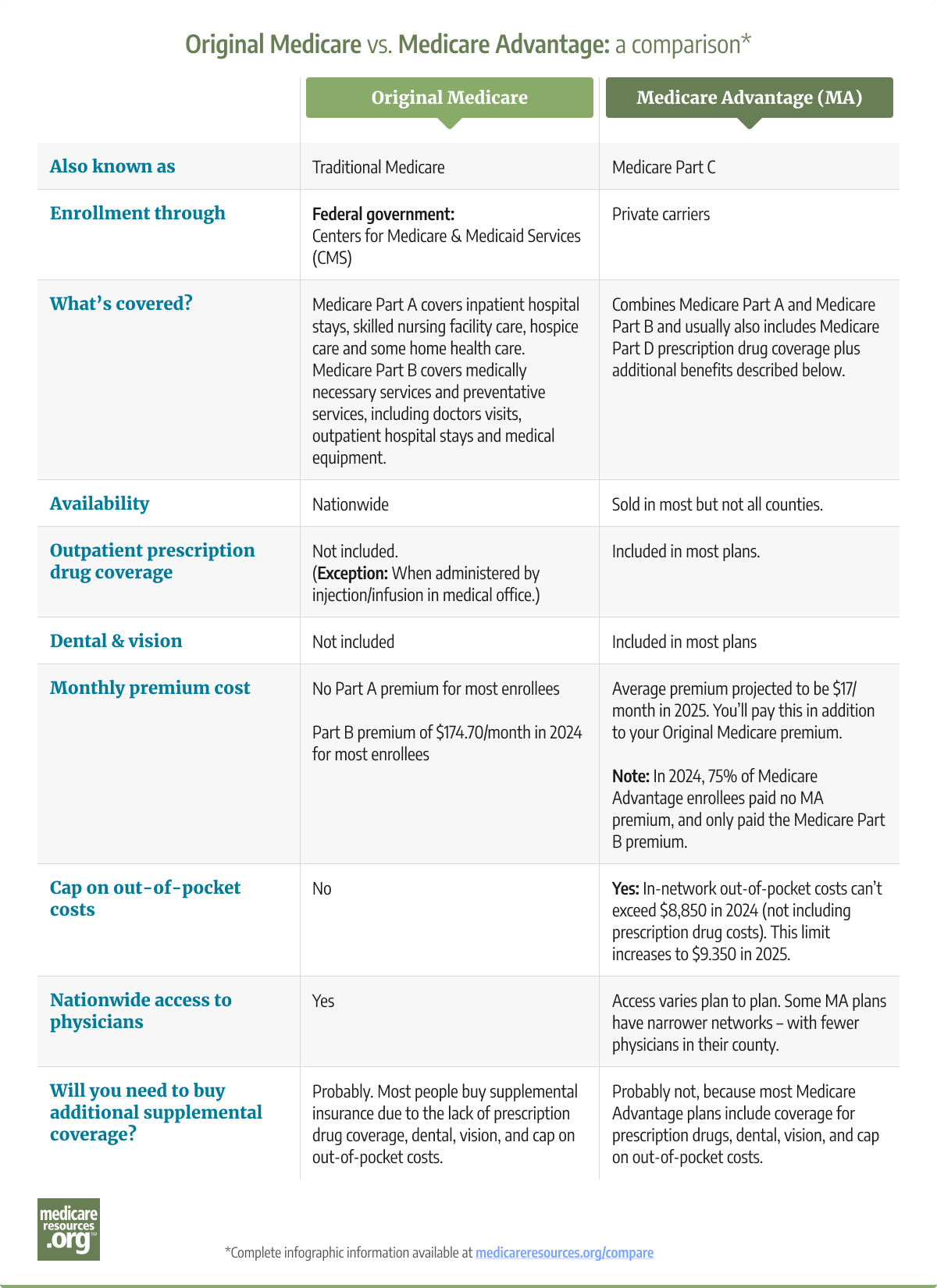

All Medicare Advantage plans are required to cover services that are covered by Medicare Part A and Medicare Part B (except hospice services, which are covered under Original Medicare for all beneficiaries). However, the out-of-pocket costs for these services vary widely between Original Medicare and Medicare Advantage. And there can be different coverage rules under Medicare Advantage plans, such as a requirement to use in-network medical providers or obtain prior authorization.

This differs from one Medicare Advantage plan to another, and also differs from Original Medicare. Original Medicare allows beneficiaries to use any provider who accepts Medicare, and prior authorization is very rarely used in Original Medicare.

Read our overview of Original Medicare.

Medicare Advantage enrollees only have one plan, rather than having to use multiple plans to get coverage for all the care they need. (For example, Medigap – also known as Medicare supplement insurance – only works in conjunction with Original Medicare, and cannot be used with Medicare Advantage).

Read our overview of Medicare supplement insurance (Medigap).

Since 2019, Medicare Advantage plans have been allowed to cover a broader range of extra benefits than they could in prior years and some Medicare Advantage plans have chosen to offer these benefits. As of 2024, 97% of Medicare Advantage plans offer some type of extra benefit not covered by Original Medicare (although, different benefits are available to different enrollees depending on availability and health status.

A note about hospice care: In most cases, this is covered under Original Medicare, even if the person is enrolled in a Medicare Advantage plan. CMS debuted a small pilot program in 2021, under which a limited number of Medicare Advantage plans are providing hospice services through the Medicare Advantage plan rather than through Original Medicare. But this pilot program is ending at the end of 2024.) So starting in 2025, all Medicare beneficiaries who need hospice care will get it through Original Medicare, regardless of whether they’re enrolled in Original Medicare or Medicare Advantage.