Q: How does Medicare’s two-midnight rule affect my hospital bills?

A: When you have surgery, you pay for more than just the procedure. You pay for anesthesiology services, facility fees to use the operating suite, and of course, the surgeon’s fees. What you may not consider is the care you receive in the hospital after surgery – nursing care, tests such as lab work or X-rays, medications, and physical therapy, if you need it – that add to the bill.

Many people assume their insurance is going to cover these expenses. But when it comes to Medicare, how much you pay out of pocket will depend on whether Medicare Part A or Medicare Part B picks up the tab.

While Part A is known as “hospital insurance,” it’s actually not enough for you to be in the hospital in order for your Part A coverage to kick in.

What is Medicare's two-midnight rule?

In 2013, CMS enacted what is known as the two-midnight rule. This rule added a clock to the admission process for hospital stays. Not only do you have to have medical reasons to stay in the hospital, but your doctor also has to deem you sick enough that your hospital stay would likely cross two midnights. Only when both these criteria are met would a patient be considered appropriate for Part A “inpatient” coverage. Otherwise, you would be considered an “outpatient” and would be placed under observation. In that case, Part B covers any care received.

If you’re approved for inpatient coverage under Part A, you would pay a fixed deductible amount for most of the services you receive during the hospital stay (a $1,632 Part A deductible in 2024 covers you up to 60 days), plus 20% of the cost of physician services you receive (those would still be billed under Part B).

If your care is not approved for inpatient status, however, you would be charged 20% for each individual service you received – up to and including room and board. It’s important to point out Part B cannot charge you more than the Part A deductible for any one item on your hospital bill.

How might the two-midnight rule apply to my recovery?

Even when you receive the very best medical care, you may still need time to recover after a hospitalization.

You could receive that care at home, in the form of physical therapy or other home services, for example. In those cases, you will turn to your Part B coverage.

Other times, you may require placement in a skilled nursing facility (SNF) such as a rehab. In that case, you would rely on Part A. The first 20 days in the SNF will be free to you. After that time, you will pay a fixed amount ($204 in 2024) for each additional day you stay in the SNF up to 100 days.

The problem is that Part A won’t cover your stay in a skilled nursing facility unless you have had inpatient orders on your medical record for at least three days. To complicate matters, the day you are transferred to the SNF does not count.

How are types of surgery covered by Medicare Part A or B?

While going under the knife is not always something you want to do, it may be something you need to do. Millions of elective surgeries are performed each year. Your admission status – inpatient or observation – could significantly impact how much you pay for those surgeries.

Every year, CMS releases a list of surgeries it considers to be inpatient appropriate. Because these surgeries are considered higher risk, they are automatically covered by Medicare Part A. In those cases, your stay does not need to meet the expectation that it will cross two midnights.

Unfortunately, CMS has started to trim its “inpatient-only” list. In 2018, it removed total knee replacements from the list. In 2020, it removed total hip replacements. CMS planned to phase out the list altogether by 2024, but this decision has been put on hold.

The repercussions of this could have a significant impact on your wallet. By moving more surgeries from Part A to Part B coverage, Medicare is potentially increasing out-of-pocket costs for its beneficiaries.

A real-life example

Imagine you are scheduled for a total hip replacement. MD Save estimates the average national cost of this surgery ranges from $15,234 to $29,901. In the real world, having insurance – including Medicare – significantly decreases those out-of-pocket costs.

In the best-case scenario (under Part A), you would pay the $1,632 deductible plus 20% of physician fees for your surgery. In the worst-case scenario (under Part B), you would pay 20% of all costs – $3,046 to $5,980 if you use the national average.

Keep in mind these numbers are only gross estimates. Without a breakdown of physician and hospital fees, it is difficult to know how much you would actually pay. Costs vary by region and by hospital. Also, some hospitals may bundle their payments, meaning that all surgery-related services may be included in one lump fee. Still, a Part A surgery is likely to cost you significantly less than a Part B surgery.

The cost issues don’t stop there. If you have complications from your surgery or if you are unable to rehab at home, you may need care in a skilled nursing facility. For the purposes of this exercise, let’s assume you need an additional 20 days of care in an SNF.

In the best-case scenario (under Part A), you would get that skilled nursing stay for free. In the worse-case scenario (under Part B), you would pay all SNF costs out of pocket. In 2023, the average daily cost was $285 for a shared room and $320 for a private room. For 20 days of care, that would be $5,700 to $6,400, not including any medical care you may need – such as physical therapy or medications. You would pay an additional 20% for each of those services.

There’s another scenario to consider here. Even if you were covered by Part A, your SNF expenses would not be covered if you did not stay in the hospital at least four days (three days of in-hospital care plus the day of transfer to the skilled nursing facility).

Are there exceptions to the two-midnight rule?

Yes. Your costs might not be affected if you have an uncomplicated surgery and go home the same day or even the day after – especially if your hospital bundles payments. However, a longer hospital stay could affect your bottom line.

Having a surgery that is not on the inpatient-only list does not mean your doctor cannot admit you as an inpatient, whether it’s on Day One or any day after your surgery. Your doctor must clearly document why your hospital stay was more complicated or higher risk than the average surgery course. Otherwise, Medicare could deny Part A coverage, sweeping you into a long appeals process.

Medicare Advantage or Medigap coverage can provide peace of mind

Most Medicare beneficiaries — about nine in ten — have some sort of supplemental coverage that will pick up the tab for some or all of the out-of-pocket costs that beneficiaries would otherwise have to pay themselves.

If you aren’t eligible for Medicaid or coverage from a current or former employer, you can choose to enroll in a Medigap plan, or, in most areas of the country, a Medicare Advantage plan.

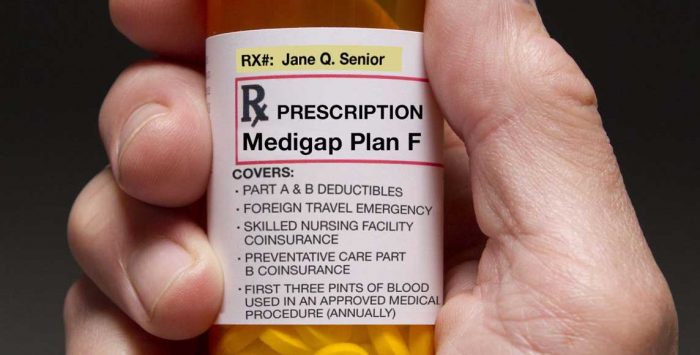

Most Medigap plans, which are purchased to supplement Original Medicare, will eliminate the worry over whether your hospital stay is paid under Part A or Part B. That’s because they’ll cover the Part A deductible and any Part B coinsurance that you incur. (Some Medigap plans – A, K, L, and M, as well as the high-deductible versions of Plan F and G – will still leave you with some out-of-pocket costs.)

If you’d rather have a Medicare Advantage plan, it will take the place of Original Medicare, with both Part A and Part B wrapped into one private plan that will likely also include Part D prescription coverage and various extra benefits. And unlike Original Medicare, there is a cap on out-of-pocket costs for Part A and Part B benefits under Medicare Advantage plans. (Annual costs can’t exceed $8,850 in 2024. (This does not include the cost of premiums.)

Like most commercial payers, Medicare Advantage plans often require a prior authorization for elective surgery. In that case, you would know before you even set foot in the door if your surgery was approved for inpatient or observation coverage.

Also, Medicare Advantage plans have the option of waiving the three-day rule for skilled nursing facility coverage. This could offer significant savings if you were to need extended care after your surgery.

Although the specifics vary from one plan to another, you’ll generally have higher out-of-pocket costs under Medicare Advantage than you’d have with Original Medicare plus Medigap. But premiums also tend to be lower with Medicare Advantage, so there’s no right or wrong answer.

Here’s a summary of points to keep in mind when you’re deciding between Medigap and Medicare Advantage.

Take home?

When you anticipate a trip to the hospital, you will want to talk to your doctor about your admission orders. It’s a conversation that could affect how much you will pay out of pocket.

Tanya Feke M.D. is a licensed, board-certified family physician. As a practicing primary care physician and an urgent care physician for nearly ten years, she saw first-hand how Medicare impacted her patients. In recent years, her career path has shifted to consultant work with a focus on utilization review and medical necessity compliance.

Dr. Feke is an expert in the field, having Medicare experience on the frontlines with both patients and hospital systems. To educate the public about ongoing issues with the program, she authored Medicare Essentials: A Physician Insider Reveals the Fine Print. She has been frequently referenced as a Medicare expert in the media and is a contributor to multiple online publications. As founder of Diagnosis Life, LLC, she also posts regular content about health and wellness to her site at diagnosislife.com.

Tags: inpatient care, Medicare Part A, Medicare Part B, out-of-pocket costs, two-midnight rule