Why would I change my Medicare plan coverage?

Medicare plan beneficiaries change their coverage for a variety of reasons, including changes in provider networks, increases in premiums, the availability of new plan benefits, and changes in Medicare Part D formularies – as well as changes in beneficiaries’ own situations.

Read more here:

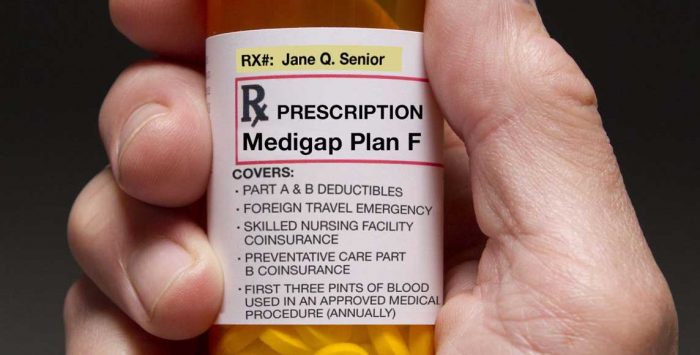

If you choose to go with a Medicare supplement insurance policy (also known as a Medigap insurance policy), you should definitely take note of the fact that Medigap plans aren’t guaranteed issue in most states after your initial enrollment period ends. That means if you apply for a Medigap policy later on – either for the first time, or because you want to switch plans – the carrier generally has the option of denying the application or charging you a higher premium based on the carrier’s underwriting requirements.

There are limited guaranteed-issue opportunities for Medigap policies after the initial enrollment window (including the one-time trial right period), and a few states have annual opportunities for people to enroll in Medigap on a guaranteed-issue basis (in most cases, this is just an opportunity to switch to a different plan, rather than newly enroll).

What do I need to do to get my Original Medicare card?

If you’re already receiving Social Security or Railroad Retirement benefits at least four months before you turn 65, you’ll be automatically enrolled in Original Medicare and your Medicare card will be mailed to you about three months before you turn 65, with your coverage taking effect the first of the month you turn 65 (at this point you’ll have a chance to reject Medicare Part B if you choose to do so, but make sure you know all the ins and outs of that beforehand).

If you’re not yet receiving Social Security or Railroad Retirement benefits prior to turning 65, you will not be automatically enrolled in Medicare. Instead, you’ll need to apply for Medicare through the Social Security Administration, which will then send your Medicare card to you.

What are the Medicare eligibility guidelines?

Aging in – for millions of individuals, eligibility for Medicare is somewhat automatic – as straightforward as reaching their 65th birthday.

If you’re aging into Medicare, there’s a lot you can do to ensure that you end up with the right Medicare plan – and that you don’t incur unnecessary costs (including penalties) along the way. Your plan premium, your Medicare benefits, your enrollment windows – and the penalties for missing them – all depend on your plan-buying decisions.

Learn how older individuals age in to Original Medicare.

Eligibility due to a disability – Although most Medicare beneficiaries are eligible due to their age, about 14% of all Medicare beneficiaries are under 65. That’s because people also become eligible for Medicare plans due to having a disability and receiving disability benefits for at least two years, or being diagnosed with amyotrophic lateral sclerosis (ALS) or end-stage renal disease (ESRD).

Who’s not eligible? – Some individuals are not eligible to enroll in Original Medicare because they haven’t lived in the United States for at least five years.

Learn whether you’re eligible for the various Medicare plans.

How much does a Medicare plan cost?

A common misconception about Original Medicare is that it’s a free government safety net that awaits beneficiaries when they reach retirement. The fact is, each type of Medicare coverage does have its own costs, similar to other health insurance you’ve purchased over the years.

So expect premiums, deductibles, copays, and coinsurance (although Medicare supplemental insurance coverage may pay some or all of the cost-sharing for you). Also, expect those costs to change each year.

Here’s a look at the plan costs for 2025.

There is assistance available for beneficiaries who may have difficulty paying for Medicare plan expenses – including premiums and out-of-pocket costs. Many lower-income beneficiaries are eligible for help via the Medicaid system, which includes Medicare Savings Programs as well as full dual-eligibility for both Original Medicare and Medicaid.