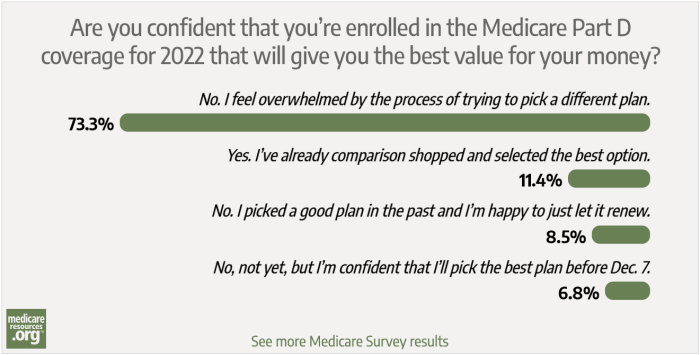

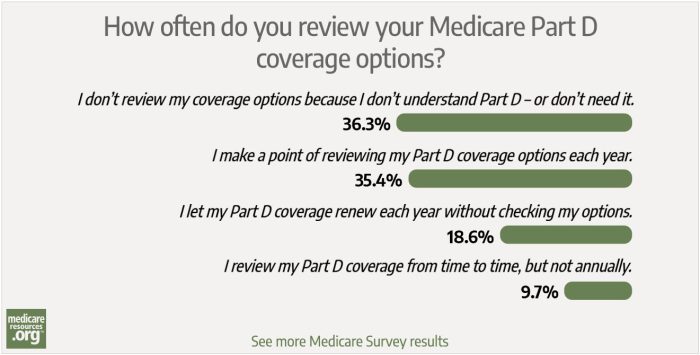

If you have Medicare Part D coverage, you’re no doubt aware that you have choices when it comes to the specific plan you buy. If any of the following situations apply to you, it could pay to swap your current plan for a different one.

You can do this each year during the Medicare open enrollment period – from October 15 to December 7. And if your Part D coverage is integrated with a Medicare Advantage plan (MAPD), you can also use the Medicare Advantage Open Enrollment Period – which runs from January through March.

(The Medicare Advantage Open Enrollment Period allows anyone with a Medicare Advantage plan to switch to a different Advantage plan or to Original Medicare. If you switch to Original Medicare, you also have an opportunity to select from among any of the available stand-alone Part D plans in your area. So this window provides a good chance for people who start the year with Medicare Advantage to make sure that they’ve got the right plan going forward, including the right drug coverage. Note that if you have Original Medicare, you cannot make changes to your Part D coverage during the Medicare Advantage Open Enrollment Period, but can make those changes during Medicare open enrollment.)

1. Your current plan’s formulary has changed

All Medicare Part D plans – including MA-PDs – have a formulary that places medications into different tiers. Drugs in a lower tier – usually generics – typically come with minimal copays. Some can even be copay-free. But the higher a tier you’re looking at for the medications you take, the greater your out-of-pocket costs will be.

A plan’s formulary can change from year to year. This means that a drug you take that starts out in a lower tier could get bumped into a higher tier in the future, thereby raising your costs substantially. If that’s the case with the Part D coverage you have, then it could be time to switch.

2. Your medication needs have changed

It always pays to find a Part D plan that offers decent coverage for the specific medications you take. But once your prescriptions change, it absolutely pays to see if there’s a plan that might offer you a better deal.

For example, if you’re paying a relatively high premium for a specific plan that places one of your recurring medications in a relatively low tier, but you then switch to a generic version of that drug that’s cheaper across the board, you may find that your total costs go down if you switch to a cheaper Part D plan.

Or, if you’ve switched to another medication that’s placed in a higher tier under your current plan, it pays to see if there’s another plan that has it in a lower tier.

If you’re enrolled in an MAPD plan and considering a plan change during the fall enrollment period or the Medicare Advantage Open Enrollment Period (MAOEP), make sure you consider your current prescriptions. And you’ll also want to consider Original Medicare plus a stand-alone Part D plan, to see if that might work best for your situation. (You have the option to leave your Advantage plan and enroll in Original Medicare plus a Part D plan during the fall open enrollment period or the MAOEP, but keep in mind that you may not have access to a guaranteed-issue Medigap plan.)

3. The pharmacies included in your plan’s network aren’t convenient

Part D plans – including MAPD plans – typically require enrollees to fill prescriptions at in-network pharmacies. If you use an out-of-network pharmacy, you may end up having to pay the full price for your medication, depending on the circumstances. If the plan you’re on doesn’t have at least one or two conveniently located pharmacies in-network, then that alone is a good reason to contemplate a switch. This holds true even if you have access to a mail-order program, since waiting for medications to arrive isn’t always an option.

4. You’re paying a high premium for a plan you’re hardly using

Sometimes, it’s worth paying up for a Part D plan that offers better coverage, because what you fork over in premiums, you make up for in copays. But if you don’t have any ongoing prescriptions, then you may be better off opting for a lower-cost plan. You have an opportunity to switch your Part D coverage annually, so you’ll be able to go back to a higher-priced plan with lower out-of-pocket drug costs if your prescription needs change in a future year (note that the opportunity to switch plans is generally limited to open enrollment, unless you qualify for a special enrollment period).

Shop around

Some people stick with the same MAPD or Part D plan and do well with it for years. But before you settle for your current plan, shop around and assess your choices.

You have the option to change your Part D plan during Medicare’s annual open enrollment window, which runs every year from October 15 through December 7. If you can’t make changes during that time, the Medicare Advantage Open Enrollment Period runs from January 1 through March 31, and gives Medicare Advantage enrollees a chance to change their coverage — including their drug plan.

Maurie Backman has been writing professionally for well over a decade, and her coverage area runs the gamut from healthcare to personal finance to career advice. Much of her writing these days revolves around retirement and its various components and challenges, including healthcare, Medicare, Social Security, and money management.