How can I be sure my Medicare prescription drug plan will cover my expenses?

Generally, a prescription written by your doctor will be covered under your drug plan if you follow these requirements:

- Make sure your doctor is up to date on the prescription drugs your specific plan covers – each plan has a different formulary (covered drug list), which means your doctor may need to select a specific drug from among various options in the drug class.

- Be certain your doctor is aware of how much medication your plan allows you to obtain at a time.

- The doctor may be required to first prescribe lower-cost (generic) drugs rather than a name-brand drug and must show that the drug he or she has prescribed is medically necessary.

How can I check whether my Part D plan covers my medications?

Medicare has a plan finder tool where you can enter your medications and see how much your out-of-pocket costs will be for each of the plans available in your area. If you’re currently taking medications, using this tool during open enrollment is essential.

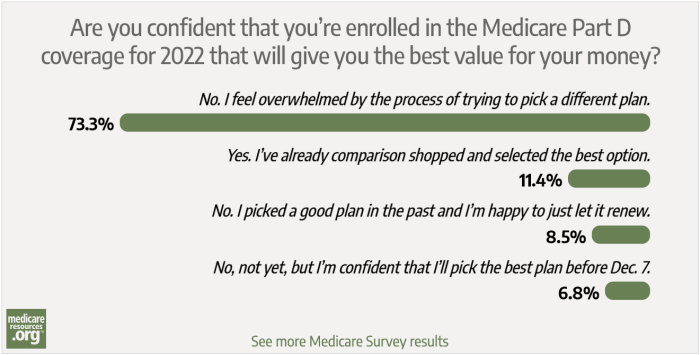

Drug formularies change from one year to the next, and different Medicare Part D plans offer different levels of coverage for different drugs. So it’s important to shop around during open enrollment (October 15 to December 7) to make sure you’re enrolling in the plan that will provide you with the best coverage for the coming year.

There have been some important improvements to Medicare Part D in recent years, as a result of the Inflation Reduction Act. These include $35 insulin, free recommended vaccines, the elimination of cost-sharing in the catastrophic coverage level, and a $2,000 cap on out-of-pocket costs as of 2025. But that cap only applies to drugs that are covered by a given plan. So it’s still important for enrollees to actively compare their plan options each fall, to make sure that the plan they have for the coming year will cover the specific medications they take.

Do I need to enroll in Part D if I'm not taking any medication?

If you’re not taking medications, you still need to enroll in a Part D plan as soon as you become eligible for Medicare (unless you have creditable drug coverage from a plan offered by your employer or your spouse’s employer or a retiree drug plan). But people in this situation often just pick the cheapest plan available. If you skip Part D altogether because you’re not taking any medications, you could end up paying a lot more in the long run, due to lack of coverage as well as the late enrollment penalty.

A person who skips Part D coverage and then ends up being prescribed expensive medication mid-year will be unable to enroll in a Part D plan until the next open enrollment period, with coverage effective the following January. And for every month that you were eligible to enroll in Part D but didn’t (and didn’t have creditable drug coverage from another source), you’ll pay a surcharge equal to 1% of the national base beneficiary Part D premium — on top of your regular Part D premium.

So if you wait three years to sign up for Part D coverage because you weren’t taking medications during those three years, you’ll pay the regular Part D premium for the plan you pick, plus a surcharge equal to 36% of the national base beneficiary premium. That surcharge will continue for as long as you have Part D, and will increase over time as the national base beneficiary premium increases.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Tags: Medicare Part D, prescription drug coverage