How will my Medicare prescription drug costs in 2025 compare with 2024?

There are several Medicare prescription drug changes taking effect in 2025, including:

- Out-of-pocket costs for covered drugs will be capped at $2,000.

- The maximum Part D deductible is increasing to $590.

- The coverage gap (donut hole) will be eliminated.

Inflation Reduction Act changes include $2,000 out-of-pocket cap

Under the Inflation Reduction act, Medicare Part D enrollees will pay no more than $2,000 in out-of-pocket costs for their covered drugs in 2025. And enrollees will have the option to spread their drug costs out in equal payments across the year, which could be beneficial to those who might otherwise have to pay the full $2,000 in just the first few months of the year.

Before 2024, there was no out-of-pocket limit for Part D coverage. But starting in 2024, the Inflation Reduction Act eliminated out-of-pocket spending once an enrollee reached the catastrophic coverage level. And in 2025, out-of-pocket costs will be further reduced, thanks to the $2,000 out-of-pocket cap.

Various other improvements to Medicare Part D benefits (and coverage of drugs under Part B) have been phased in since 2023 as a result of the Inflation Reduction Act. These include $35 insulin, free recommended vaccines, and lower coinsurance costs for certain infusion drugs covered under Medicare Part B.

Suggested: Does Medicare cover the shingles vaccine?

Maximum deductible increasing to $590

The Part D prescription drug deductible was a maximum of $545 in 2024, and that cap is increasing to $590 in 2025. Some plans have deductibles well under these amounts (or no deductible at all), but no plans can have deductibles that exceed $590 in 2025.

After you pay your deductible, you’ll pay copays (a fixed amount) or coinsurance (a percentage of the cost) for your medications until you’ve spent $2,000 in out-of-pocket costs. After that, your covered drugs will have no out-of-pocket costs for the rest of the year.

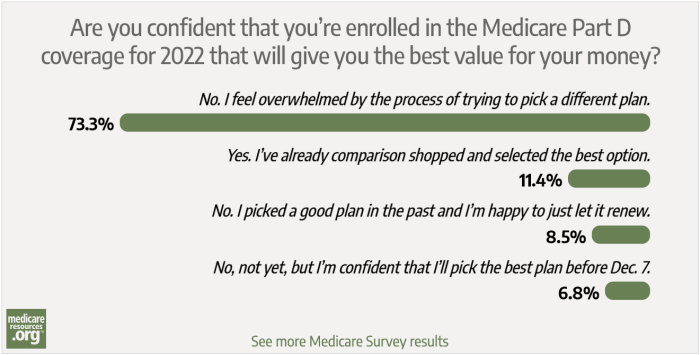

It’s important to mention that changes to your Medicare Part D costs can stem from changes in your own prescription needs, changes in your plan’s design, or a plan change that you make during open enrollment (October 15 – December 7). It’s important to carefully compare the various options each year during open enrollment to see how your existing plan — and the other plans available in your area — will cover your specific drugs for the coming year.

This is true whether your Part D coverage is provided by a stand-alone plan or as part of a Medicare Advantage plan. But if you have a Medicare Advantage plan, you’ll need to also consider how the plan and available alternatives cover the rest of your medical needs, in addition to your prescription needs.

(Medicare’s plan comparison tool is useful for determining how each plan will cover your prescription drugs, and what your out-of-pocket costs will be. If in doubt, it’s important to seek assistance from a broker or SHIP counselor, or to call Medicare or the health plan directly.)

What happened to Medicare's 'donut hole'?

As of 2025, the Medicare Part D donut hole will no longer exist. This is because of the changes described above, due to the Inflation Reduction Act.

Medicare’s Part D prescription drug coverage gap or “donut hole” was gradually “closed” over several years as a result of the Affordable Care Act, but there was still an initial coverage limit where cost-sharing could change (depending on the plan) and then a transition to different cost-sharing if the catastrophic coverage level was reached.

As of 2025, a standard Part D plan will have a deductible phase (no more than $590), and then an initial coverage phase during which enrollees pay 25% of the cost of their covered drugs (plans can have lower deductibles and lower out-of-pocket costs in the initial coverage phase). Once the person’s out-of-pocket costs reach $2,000 in 2025, their Part D plan will pay for their covered drugs for the rest of the year, with no additional cost-sharing.

Many Part D enrollees will not reach the $2,000 out-of-pocket cap in 2025, because their drug costs aren’t high enough. For those individuals, the deductible and the copay or coinsurance for their covered drugs will be the most important factor in determining how much they spend on medications. Since Part D plans often charge coinsurance (a percentage of the cost) rather than copays (a flat amount), some people may find that their costs go up from one year to the next, simply due to the rising prices for prescription drugs. If you’re paying 25% of the cost and the cost goes up, your portion goes up as well.

But for enrollees who need high-cost medications, the $2,000 cap will be an important new benefit. And the option to spread out-of-pocket costs across the full year could help some enrollees better manage their drug costs. You can reach out to your Part D plan if you’d like to take advantage of the medicare Prescription Payment Plan option in 2025.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Footnotes

Tags: Medicare Part D, out-of-pocket, prescription drug coverage