Nine out of ten people age 65 or older take prescription drugs, with the average person in that age group taking more than four prescriptions per day. With statistics like these, it’s no surprise that prescription costs are among the top concerns for Medicare beneficiaries.

Even with Medicare Part D or private insurance to help cover the costs of prescriptions, there are still co-pays, coinsurance, and coverage gaps which can leave beneficiaries paying out-of-pocket. These expenses can create a financial drain and stretch fixed incomes to the breaking point – and even drive beneficiaries to risky behaviors that include rationing – or foregoing – their prescriptions.

But prescription drugs – and drug coverage – can be less expensive if you’re willing to do a little research and to reach out for help. Here are eight strategies that will empower you to take control of your drug coverage and your medication costs.

1. Compare Medicare plans

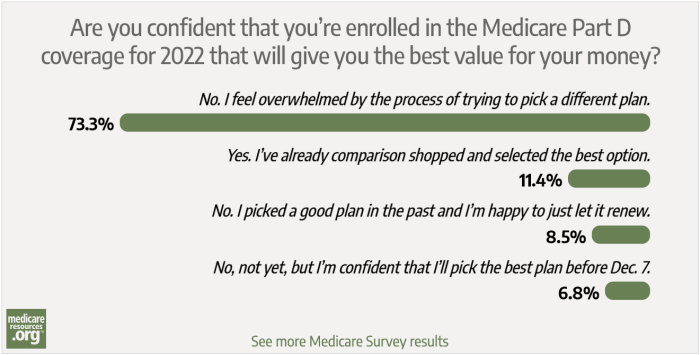

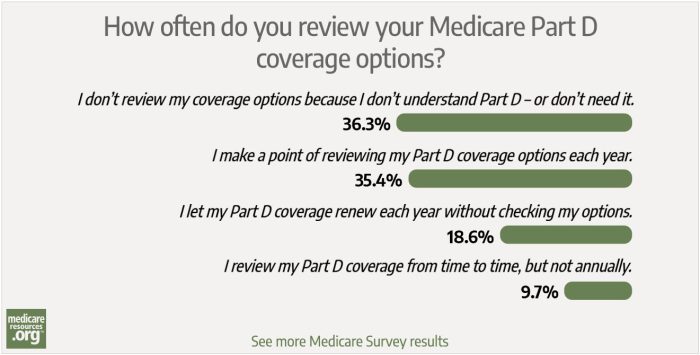

The first step toward curbing your drug costs begins at enrollment. When you’re choosing a Medicare Part D plan (either a stand-alone plan or Part D coverage that’s integrated with a Medicare Advantage plan), look closely at the specifics of how the drug coverage works. Pay attention to co-pays, deductibles, and coinsurance amounts, and be sure to use Medicare’s plan finder tool to see how each plan will cover any medications you’re already taking.

Or call

866-445-0071 (TTY 771) to speak to a licensed insurance agent.

(Mon-Fri 8am-9pm, Sat 10am-7pm ET)

It’s important to understand that each Part D plan has its own formulary (covered drug list) and out-of-pocket costs can vary considerably from one plan to another, even across plans that all cover a certain drug. To start comparing Medicare Part D plans, you can visit Medicare.gov.

2. Talk to your prescriber

Many prescriptions are long-term, and taking them can become part of your daily routine. It can be easy to one day find yourself with a regimen of pills – including some you may not need to take anymore, or that may now have a less expensive alternative. By taking an inventory of your prescriptions and talking to the person who prescribes them for you, you may be able to eliminate redundancy, cut prescriptions entirely, or find better or equivalent lower-cost alternatives and generics.

While speaking with your prescriber, also inquire if you can get a prescription for a 90-day supply. Not only will this eliminate the need for monthly refills, it may also reduce your out-of-pocket costs. The 90-day savings can stretch even further when coupled with a mail-order prescription service — which you might find more convenient and less expensive than a monthly trip to your local pharmacy.

3. Shop around for your pharmacy

Just as we can become complacent in our daily medication regimen, we can also fall into patterns with our pharmacy of choice. The location, staff, or store loyalty may keep you coming back, but that loyalty might be straining your pocketbook.

The prices for prescriptions can vary drastically from pharmacy to pharmacy – even if one pharmacy is physically located right down the street from another. Amateur sleuth time: call or visit new pharmacies to price-check your medications. This is important to keep in mind when you’re comparing Part D drug plans (step 1, above): You’ll want to check to see how the various plans cover your medications at a range of different pharmacies in your area. You might find that even with the same plan, your costs are lower if you switch to a different pharmacy.

You can compare pharmacy costs at a variety of in-network providers, including major national pharmacies, grocery store pharmacies, and big-box retailer pharmacies. Be sure to also take a look at small independent pharmacies, which negotiate different deals with drug manufacturers and distributors and can sometimes offer significant savings.

And as noted above, you’ll also want to compare mail-order pharmacy options, as that might be the most convenient and possibly the lowest-cost option.

4. Discount prescription cards

Sometimes, the best way to save money on your prescriptions, is to NOT use your insurance. An online prescription discount site (such as GoodRx) will offer a simple online search of your drug and show you multiple prices and options in your area along with coupons or codes to get discounts.

Discount prescription cards are also available from retail outlets, and provide similar savings. Even better, many prescription cards now offer delivery services, which often include even deeper discounts.

Under stand, however, that if you use a discount Rx program instead of your Medicare coverage, your out-of-pocket costs won’t be counting towards your Part D TROOP (true out-of-pocket) or out-of-pocket maximum (if you have an employer-sponsored plan). Depending on what your pharmacy needs end up being throughout the year, that could be an important point to keep in mind.

That will be especially true starting in 2025, when total annual out-of-pocket costs under Part D will be capped at no more than $2,000 — but only for drugs covered by your plan and processed through the plan’s claims system.

5. Go to the source: pharmaceutical assistance programs

Most pharmaceutical manufacturers offer discounted or free prescription drugs for qualified individuals. Not every company will offer discounts on every drug, but when available, these programs can help to make medications more affordable, particularly for high-priced and specialty prescriptions. Reach out to a company directly, or search the database at Medicare.gov to determine drug availability and where to go for savings.

As an example, the popular rheumatoid arthritis drug Humira – manufactured by AbbVie Biopharmaceuticals – can retail for $7,000 for a month’s supply. By accessing the company’s income-based assistance program, some consumers can get Humira prescriptions filled for as little as $5 a month – or even free (note that this program is not available for people who are using Medicare Part D coverage, but it can potentially be available for those with other commercial insurance, including employer-sponsored plans offered to employees or retirees).

6. State pharmaceutical assistance programs

Another resource in the battle against prescription drug costs is pharmaceutical assistance programs in each state. For a list of state-based assistance programs, you can contact your state’s Insurance Department or Department of Health and Human Services, Elderly and Adult Services Division.

State-based assistance programs do vary widely. Some require an enrollment fee, set income requirements, or allow application only during coverage gaps. Others cover medicines for certain conditions only.

State Health Insurance Assistance Programs also provide free counseling to explain Medicare prescription coverage options available in your state.

7. Extra Help

Extra Help is a federal government program for Medicare beneficiaries who have prescription drug coverage, but who need help covering the prescription costs, co-pays, deductibles, premiums and coinsurance for Medicare Part D prescription drug plans.

To determine whether you’re eligible, Social Security will require you to submit an application that will help the agency assess the value of your savings, assets, income, and other sources of wealth (apart from your primary residence). If you qualify for Extra Help and aren’t currently in a Medicare prescription plan, you may even qualify for money back on prescription expenses you accrued while waiting to be approved.

8. National and community charity programs

America is a nation of givers, and home to nonprofits dedicated to practically every cause, including medications for individuals in need. Begin with an online search for a particular condition, and you may find resources that can reduce your prescription costs. The National Council on Aging offers a tool that searches for benefits programs based on your geographic area.

Prescription drugs can improve the quality of your life – and even save your life. Devoting a little time to research can help ensure you won’t be priced out of the medications you need.

Jesse Migneault is a journalist and editor who has written about business, government and healthcare – including public and private-payer health insurance. His articles have appeared in HealthPayerIntelligence, the Hartford Courant, Portsmouth Herald, Seacoastonline.com, Foster’s Daily Democrat, and York County Coast Star.

In addition, his work has been cited by health industry stakeholders such as the Eugene S. Farley Health Policy Center, Association of Healthcare Journalists, American Academy of Actuaries, Kaiser Permanente, blueEHR, San Diego Law Review, Medicare Agent News, healthjournalism.org, and Concierge Medicine among others.

Footnotes