Once you’ve decided that you want more coverage than Original Medicare alone, the next step is figuring out whether one of the many private insurance options will fit your needs and budget.

Your options …

When you enroll in Medicare, assuming you don’t have supplemental coverage from a current or former employer, you can either opt for Original Medicare and supplement it with Medicare supplement insurance (Medigap) and/or a Medicare Part D prescription drug plan (Part D), or you can choose a Medicare Advantage plan.

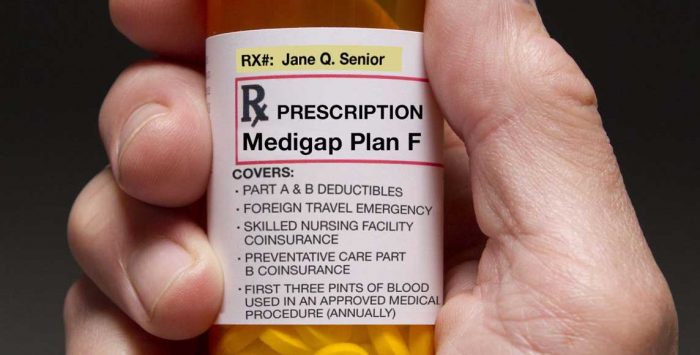

A Medigap plan will pick up the tab for varying amounts of your out-of-pocket costs (e.g., deductibles, copays and coinsurance) under Original Medicare (the level of coverage you get depends on the Medigap plan you choose), and a Part D plan will provide prescription drug coverage.

A Medicare Advantage plan wraps various benefits all in one policy: It includes all of the benefits of Original Medicare, has a cap on out-of-pocket costs (unlike Original Medicare), and most Medicare Advantage plans also include prescription drug coverage.

… and 11 ways to decide

There’s no right or wrong choice – Medicare Advantage and Original Medicare with or without supplemental coverage both can work well. (Note that if you have only Original Medicare without any supplemental coverage at all, it does not have a cap on how high your out-of-pocket costs can get and you will not have any coverage for outpatient prescription drugs.) But there are numerous factors to keep in mind when you’re making the decision:

1. Medical conditions

Would you qualify for a Medicare Advantage Special Needs Plan (SNP)? SNPs are geared to the needs of very specific populations, and can be a good choice for people with certain medical conditions, as well as those who are institutionalized or who are Medicare-Medicaid dual eligible. If you’re eligible for an SNP and one is available in your area, you can enroll in it. But you are not required to do so, and can choose a different plan if that’s your preference.

2. Disability

Are you under age 65 and on Medicare because of a disability? If so, you may not have access to a Medigap plan. Federal law doesn’t require Medigap coverage to be guaranteed issue for enrollees under age 65. About two-thirds of the states have some sort of guaranteed-issue provisions for disabled Medigap enrollees, but many of those states still allow carriers to charge higher premiums and/or only offer one plan when enrollees are under the age of 65. (You can click on your state on this map to see how Medigap plans are regulated).

Although Medigap can be difficult or expensive to obtain if you’re under 65, you can get a Medicare Advantage plan if you’re Medicare-eligible, even if you’re under 65. People with End-Stage Renal Disease (ESRD) generally could not enroll in Medicare Advantage prior to 2021 unless the Medicare Advantage plan was an ESRD SNP. But this changed as of 2021 under the terms of the 21st Century Cures Act; Medicare Advantage plans are now guaranteed issue for all Medicare beneficiaries, including those with ESRD.

3. Missed enrollment

Are you enrolled in only Original Medicare and your Medigap initial enrollment window has already passed? If so, it might make sense to consider a Medicare Advantage plan since there’s an annual open enrollment period for Medicare Advantage.

Or call

866-472-0949 (TTY 771) to speak to a licensed insurance agent

(Mon-Fri 8am-9pm, Sat 10am-7pm ET)

With Medigap, if you apply after your initial open enrollment period has ended, insurers in most states can use medical underwriting to determine your premium and eligibility for coverage. Depending on your health, that could make a Medigap plan expensive or impossible to get. (On the other hand, if you’re in good health, you could potentially be allowed to enroll in a Medigap plan at any time.)

The limited window of opportunity for a guaranteed-issue Medigap plan is also an important consideration if you’re planning to enroll in a Medicare Advantage plan. Be aware that after your trial right period ends, and assuming you don’t qualify for one of the other limited guaranteed-issue circumstances, you will probably not have an opportunity to enroll in a Medigap plan without medical underwriting in the future. (It depends on where you live, but most states do not have ongoing guaranteed-issue rights for Medigap plans.)

Switching from Medicare Advantage back to Original Medicare is easy during open enrollment or the Medicare Advantage open enrollment window. But if your health is poor and you don’t have a guaranteed-issue right, adding a Medigap plan may be expensive or impossible.

Note that if you’re in a Medicare Advantage plan and the plan is terminating at the end of the year (meaning you can’t renew your coverage), you will have a guaranteed issue right to most of the available Medigap plans in your area, if you decide to switch to Original Medicare instead of picking a different Medicare Advantage plan.

4. Extra benefits

Do you care about extra benefits like coverage for dental, vision, hearing aids, and gym memberships? These are often covered by Medicare Advantage plans, but not Medigap.

And the federal government relaxed the rules starting in 2019 and 2020, to allow Medicare Advantage insurers to offer additional benefits, which some insurers have gradually started to offer. These include things like assistance with transportation, household chores, and utility bills, as well as stipends to help purchase nutritious food. If these types of extra benefits are important to you, check to see what benefits the Medicare Advantage plans in your area are offering.

(Note that some extra benefits are only provided to chronically ill enrollees with specific medical conditions, while others can be provided to all enrollees; be sure you understand the specifics of the plan you’re considering.)

Do you want included prescription drug coverage? Most Medicare Advantage plans (89% in 2024) offer prescription drug coverage via integrated Part D coverage. But if you opt for Original Medicare and a Medigap plan, you’ll need to also purchase a Medicare Part D plan to have prescription drug coverage, since Medigap plans sold after 2005 do not include prescription drug coverage.

Read our overview of Medicare Part D, including information about enrollment and costs.

5. Premiums

Here’s a big one: premium cost. In most areas, there are “zero-premium” Medicare Advantage plans available. (With these plans, you still have to pay for Medicare Part B premium.) According to a KFF analysis, 99% of Medicare beneficiaries have access to at least one zero-premium Medicare Advantage plan for 2024.

But while there are zero-premium Medicare Advantage plans available (and those are the most popular option, selected by about three-quarters of enrollees), the enrollment weighted average premium for Medicare Advantage plans in 2024 is about $14/month. (in addition to the cost for Medicare Part B). And that’s after accounting for the fact that the majority of enrollees pay $0 for their Medicare Advantage plan.

If you opt for Original Medicare with supplemental coverage (assuming you don’t have supplemental coverage from Medicaid or an employer-sponsored plan), the cost of a Medicare Part D plan and a Medigap (Medicare Supplement) plan will need to be added to the cost of Part B to determine how much you’ll spend in total monthly premiums.

The weighted average premium for a stand-alone Part D plan in 2024 is $43/month. But there is significant variation from one plan to another. It’s common to see stand-alone Part D plans’ premiums range from as little as $0/month to more than $100/month.

The premiums for Medigap/Medicare Supplement insurance plans vary considerably depending on which plan you select, where you live, and how old you are. According to a NerdWallet analysis of North Carolina Medigap premiums, which are similar to the U.S. average, Medigap plan premiums vary from about $30/month to more than $400/month, depending on the insurer and the plan design.

Clearly, the average total premium for Medicare Advantage plans (including prescription drug coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare plus Medigap will generally have lower out-of-pocket costs, if and when they need medical care, than an enrollee with Medicare Advantage (see the next section about out-of-pocket costs).

But it’s important to remember that these are just averages, and there’s wide variation in premiums from one plan to another and from one state to another. Not surprisingly, in states where Medigap plans tend to be more expensive than the average, Medicare Advantage tends to be more popular.

6. Out-of-pocket exposure

On the other hand, how important is out-of-pocket exposure? With most Medicare Advantage plans, you’ll pay coinsurance and copays, and the out-of-pocket maximum for in-network care can be as high as $9,350 in 2025 for services that would be covered under Medicare Part A and B. Medicare Advantage enrollees will incur additional out-of-pocket costs for the prescription drug component of their coverage, since that’s not a benefit that would be covered by Medicare Parts A and B.

With Medigap, there are plans available that pay nearly first-dollar coverage for all Original Medicare-covered services, leaving you with little to no out-of-pocket exposure. (For people who became eligible for Medicare prior to 2020, there are still plans available that cover all of the out-of-pocket costs for Original Medicare-covered services. For people who became eligible in 2020 or later, the most comprehensive Medigap plans do still require the beneficiary to pay the Part B deductible — $240 in 2024 — out of their own pockets). The most comprehensive Medigap plans tend to be among the more expensive options; less expensive options leave enrollees with varying amounts of out-of-pocket costs for services that are covered by Original Medicare.

There’s a separate out-of-pocket exposure for prescription drug coverage, regardless of whether you’ve got a Medicare Advantage plan with prescription drug coverage, or a stand-alone Part D plan. Historically, there has not been a cap on out-of-pocket costs under Medicare Part D, but the Inflation Reduction Act has changed that. Starting in 2024, out-of-pocket costs are no longer charged once a person reaches the catastrophic phase of Part D coverage. And starting in 2025, Part D out-of-pocket drug costs are capped at $2,000.

7. Plans to travel

Do you plan to travel outside the United States during retirement? Original Medicare doesn’t cover foreign travel except for a few rare circumstances, but most Medigap plans provide some coverage for foreign travel. (80% of the cost of emergency care if received within the first 60 days of a trip, limited to a $50,000 lifetime cap, and with a $250 annual deductible.)

Medicare Advantage plans can cover foreign travel beyond Original Medicare’s limited situations, but unlike standardized Medigap policies, each Medicare Advantage plan is different, and you must check the plan details regarding foreign travel before enrolling.

8. Network size

Do you care how extensive your network is? Nearly all medical providers participate in Medicare. And 89% of non-pediatric primary care physicians are accepting new Medicare patients. (For Medicare Advantage, provider participation in each plan’s network varies, so a provider who is in-network with one Medicare Advantage plan might not be in-network with another plan). If you enroll in Original Medicare + Medigap, you can see any medical providers, nationwide, as long as they accept Medicare.

With Medicare Advantage, each plan has its own network, and you may be limited to a much more local or regional area. Even within your local area, a Medicare Advantage plan will have certain in-network providers you can use, but you likely won’t be able to access all of the local medical providers who accept Original Medicare.

Original Medicare paired with a Medigap plan and Part D coverage might be the better choice if network size is a concern, or if you expect to travel widely within the U.S. during your retirement. But if you have a specific provider in mind, do your homework before you pick a coverage option, to make sure that your plan will cover care from that provider.

9. Plan availability

Before you decide on the best solution for your health insurance needs, you’ll want to see what’s available in your area. Although most Medicare beneficiaries have access to a wide range of Medicare Advantage, Medigap, and Part D plans, the options vary considerably from one area to another.

There are Part D and Medigap plans available nationwide (see what’s in your area with the Medicare plan finder tool), but there are some areas of the country where no Medicare Advantage plans are available (mostly rural areas in the western part of the U.S.). If you’re in an area where there are no Medicare Advantage plans available, your only option is Original Medicare. Medigap and Medicare Part D plans are available nationwide, so you’ll have the option to supplement with those if that’s your preference.

10. Plan change flexibility

Although Medigap, Part D, and Medicare Advantage plans are all guaranteed issue for all enrollees during their initial enrollment period, Medigap plans aren’t guaranteed issue after that in most states. So while Medicare Advantage plans and Part D have an annual open enrollment period that lets enrollees switch plans, Medigap issuers can use your medical history to determine eligibility and premiums if you’re enrolling after your initial enrollment period and don’t have a guaranteed-issue right.

If the ability to easily switch back and forth among plans is important to you, a Medicare Advantage plan will give you that flexibility. But on the other hand, your ability to switch away from Medicare Advantage altogether (and enroll in Original Medicare) at some point in the future could be hindered by the fact that you may find that you can’t enroll in a Medigap plan at that point due to your medical history.

11. Having Medicaid or a Medicare Savings Program

Original Medicare covers many services, but it doesn’t cover long-term care benefits and can leave enrollees with large cost-sharing expenses. Medicaid pays for some services that Medicare doesn’t cover, for enrollees whose incomes and assets make them eligible for Medicaid. If you have Medicaid or a Medicare Savings Program (MSP) – a program where Medicaid pays for Medicare premiums and cost-sharing – your enrollment options are different than if you only had Medicare.

Some Medicare Advantage plans specialize in covering eligible low-income Medicare beneficiaries. These are known as Dual Eligible Special Needs Plans (D-SNPs), and are available in every state. If you have Medicare and Medicaid, you should have few out-of-pocket expenses if you see providers enrolled in both programs – regardless of whether you enroll in a D-SNP. Receiving coverage through a D-SNP may require you to see only providers who participate with the D-SNP, depending on whether the plan has out-of-network benefits.

Some D-SNPs offer additional coverage, such as home care, and dental or vision benefits. D-SNPs can also help coordinate all of the health services you receive. But low-income Medicare beneficiaries may find that they’re better off with Original Medicare paired with regular (i.e., fee-for-service) Medicaid as secondary coverage, if their providers accept those programs but not D-SNP plans. In many states, the fee-for-service Medicaid benefit also covers at least some dental and/or vision care.

Read our overview of programs available to Medicare beneficiaries with limited incomes and assets.

There’s no ‘right’ answer

Two people in the same area, who have access to the same plans, might choose very different approaches to their Medicare coverage. One might select a zero-premium Medicare Advantage plan, while the other might choose Original Medicare plus a comprehensive Medigap plan (e.g., Medigap Plan G) and a Medicare Part D prescription drug plan.

The one with the Medicare Advantage plan would rather save money on premiums, and doesn’t mind the higher out-of-pocket exposure and limited provider network her plan provides. The other person, on the other hand, is willing to pay higher premiums in trade for the lower out-of-pocket costs and nationwide provider choice that comes with Original Medicare.

Ultimately, the choice between Medicare Advantage and Original Medicare with supplements is a personal one that reflects each applicant’s health, risk tolerance, personal preferences and approach to personal finances.

And there are varying degrees of coverage within each type of plan. Medicare Advantage plans include extra benefits that aren’t available with Original Medicare + supplemental coverage, and some Medicare Advantage plans have out-of-pocket maximums well below the federally allowed limit. (The average in-network out-of-pocket maximum for Medicare Advantage plans in 2024 is under $5,000.)

And while some Medigap plans, like Plans C and D (as well as Plans F and G, for people who were eligible for Medicare prior to 2020), cover most of an enrollee’s out-of-pocket costs under Original Medicare, other Medigap plans, like Plan N, for example, are less robust.

Neither option is universally better or worse than the other, and a good broker will help you determine which option is best for you. Here are a few points to keep in mind when you’re working with a broker:

- Depending on the state in which you live, and the carriers that offer plans in your area, total broker commissions could vary considerably between Medicare Advantage and Medigap + Part D coverage. Keep that in mind if your broker seems unwilling to discuss a range of plan options with you.

- Broker commission amounts are capped for Medicare Advantage and Part D plans, but not for Medigap plans, although commissions for Medigap plans also tend to be lower. (Data on the commission amounts that insurers pay brokers for Medicare Advantage and Part D plans are available here.)

- There are fairly strict Medicare regulations that pertain to marketing tactics that can be used for Medicare Advantage plans, but those rules don’t apply to marketing for Medigap plans. Some brokers might cold call prospects to discuss Medigap coverage, then use bait-and-switch tactics to push the person towards Medicare Advantage instead, once they’ve made the initial contact.

- A good broker will work to understand your specific needs and goals, show you multiple plan options, and will devote sufficient time to answering your questions. The process shouldn’t make you feel pressured.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Footnotes