The way Medicare plans are alphabetized – from A to D – one might be fooled into thinking that there are but a few options to consider.

But deciding which Medicare coverage is right for you is definitely not as easy as a multiple-choice question with a single right answer.

Medicare was designed with the idea that the vast majority of Americans would eventually receive a uniform level of coverage and care once they became eligible. And recipients do receive a basic level of coverage. But that basic level also has some gaps, including a lack of coverage for prescription drugs, dental care, and vision care, and the lack of a cap on out-of-pocket costs.

To figure out how you can fill those gaps, you’ll need to have a basic understanding of the parts of Medicare and what each one covers.

Medicare coverage options

The main coverage options include:

- Original Medicare, which is comprised of:

- Medicare Part A – hospital insurance

- Medicare Part B – outpatient coverage

- Medicare Advantage (Part C, which replaces Part A, Part B, and in most cases, Part D)

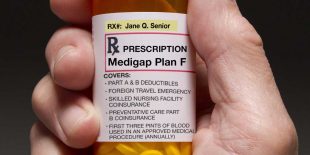

- Medicare Part D – prescription drug coverage

- Medigap – Medicare supplement insurance

Read more about those basic coverage options – and also how to improve or change your coverage – in the articles below: